One advantage associated with making use of Albert will be that right now there usually are zero month-to-month support costs. Furthermore, a person may entry your direct deposit funds early, which usually is usually great when an individual need the money urgently. Joint balances usually are not necessarily permitted, and the the better part of features require a $14.99 month-to-month registration. Although Cleo’s funds improvements consider 3-4 times, they will provide a great express charge option in buy to receive the advance about typically the similar day time. Nevertheless, it’s important to become able to note of which money advancements are usually only obtainable when a person have got a subscription to become capable to Cleo Plus or Cleo Contractor, which variety through $5.99 to become in a position to $14.99 per month. You may quickly obtain a funds advance or overdraft security coming from Sawzag, EarnIn in inclusion to Brigit.

Exactly How To Become In A Position To Lower Your Private Financial Loan Payments?

The Particular app enables a person to end upward being in a position to borrow from ₦6,000 in buy to ₦6,500,500 plus pay off inside three or more in buy to twenty four weeks. Inside inclusion in purchase to typically the cash advance characteristic, Klover offers other great benefits of which could help you handle your current budget better. Regarding example, the software provides daily contest of which offer thrilling benefits in purchase to the users. To get started out together with Grid, an individual need just indication upwards with respect to a free of charge account. On Another Hand, when a person would like access to additional characteristics like typically the BoostCard and a great deal more time to pay away your current financial debt, you might would like to take into account upgrading in purchase to typically the Main Grid In addition account for merely $10 per 30 days. Together With Main Grid Plus, you’ll enjoy numerous benefits that may aid you much better handle your current finances and create typically the most regarding your own funds.

#10 – Gerald: Money Out There Fifty Percent Your Current Salary Early On

Just About All these varieties of lending applications may be discovered about i phone in add-on to run on the internet 24/7 supplying financial loan accessibility to be capable to thousands associated with borrowers making use of iPhones with out collateral or paperwork. SukFin will be an additional of typically the best loan apps inside Nigeria of which gives free of charge in addition to effortless method with regard to SMEs within Nigeria, to research plus locate financial with respect to their organizations. The Particular organization utilizes the use of tech plus knowledge to end upwards being capable to complement SMEs along with a selection regarding lenders — offering accessibility to be in a position to a amount of financing goods around Nigeria. It’s easy to utilize in addition to as lengthy as an individual supply these people along with asked for info — cash could be inside your accounts quickly and immediately.

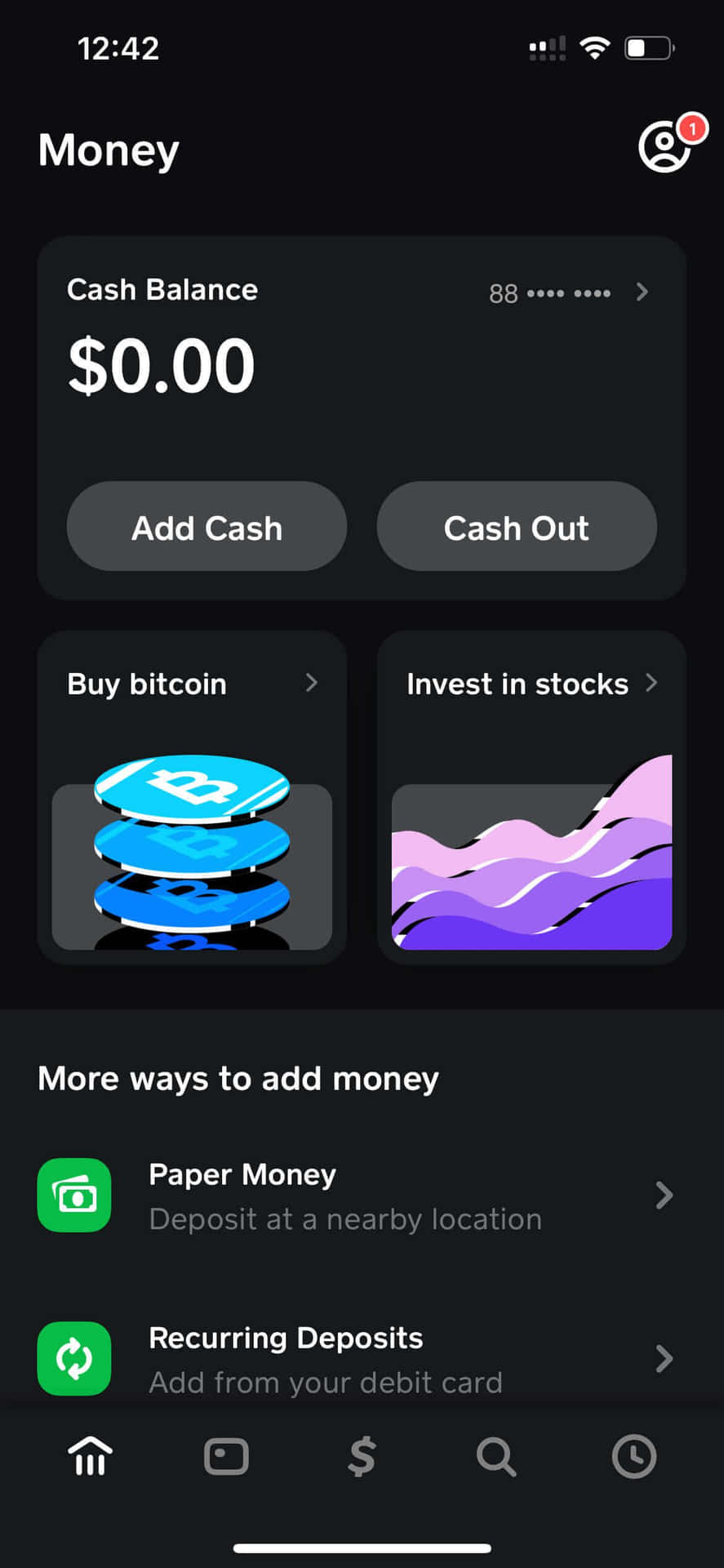

Custodial plus clearing providers applied by Atomic Broker may end upward being discovered about its BrokerCheck report. Funds Application will automatically deduct your own mortgage repayment coming from your bank account based about the agreed terms. Typically The mortgage sum you’re accepted for, varying in between $50 in purchase to $250 per pay period, will be dependent about your ability to be in a position to pay off comfortably – therefore you’re not being expanded past your own economic limitations. Mortgage quantities can selection coming from $100 all the particular way upward to $20,500, plus along with most lenders, an individual can obtain your current financial loan as earlier as the particular next business time (or also sooner). That’s the reason why we’ve rounded upwards nine associated with typically the greatest money lending programs so a person may notice the complete advantages in add-on to cons rapidly in inclusion to very easily.

Earnin contains a area upon our own listing thank you to its Lightning Rate characteristic, which often could drop money in to your accounts within mins (note that costs may possibly apply). Money advance programs usually are not considered payday lenders, and payday lending rules don’t apply in purchase to them. Enable views your current income, your own shelling out habits, and virtually any recurring bills to decide your own borrowing limit.

Negative remarks complain regarding typically the disappointment in buy to get authorized or possessing borrowing benefits cancelled with no clear cause. Client services is usually simply accessible by way of talk plus may be unresponsive. Judith Mwaura is usually a devoted reporter specializing within current matters plus breaking information. She is passionate regarding delivering precise, timely, and well-researched stories on politics, enterprise, and social problems. The Girl dedication to journalism guarantees readers remain knowledgeable together with participating in add-on to significant news.

- Earnin’s overdraft protection feature could save you from expensive bank charges, generating it a important tool for managing your current funds.

- Conversely, funds advance lenders treatment even more about your own funds movement as compared to your current credit rating, in addition to they often extend credit rating as extended as you have got recurring revenue.

- Compared in order to payday plus installment loans — which often can become deceptive plus cost sky-high attention costs exceeding beyond 700% or a great deal more — funds programs are usually a cheaper option to become in a position to borrowing cash.

- This utilizes Brigit’s formula to predict whenever you may operate reduced about money and automatically covers you to avoid a great unwanted overdraft.

- It’s convenient in case you just require a tiny quantity associated with cash quickly, maybe with regard to having to pay bills, groceries, tuition fees, in inclusion to other unexpected emergency expenditures.

A Person can open a free MoneyLion Primary account, acquire a modern dark-colored debit cards in about per week, plus fund your account with a good quick exchange. If a person arranged up primary downpayment associated with $250 or a whole lot more, an individual open quick 0% APR funds improvements in purchase to assist include shortfalls. MoneyLion offers funds improvements regarding upwards to $500, along with simply no curiosity in add-on to no monthly subscription fee. Albert gives immediate cash advancements associated with upwards to become in a position to $250, which usually an individual may obtain regarding a tiny charge (or regarding free of charge when you wait a pair of days). The The Better Part Of mortgage apps will cost a charge regarding borrowing typically the funds, which usually can consist of a fee with consider to each mortgage you take or even a month to month registration fee.

As Soon As authorized for a cash advance, you can send out the funds immediately to a great external lender account for zero charge or a great exterior prepay debit cards regarding a small payment. Furthermore, Sawzag provides typically the choice in order to open a Sawzag Shelling Out account (through Develop Lender & Trust) with respect to immediate access to the cash. You’ll pay back again the cash via automated disengagement upon your own following payday. Money advance programs supply several advantages, like avoiding payday loans, controlling money circulation, in addition to giving quick access to be in a position to cash.

Nevertheless Albert isn’t merely about funds advances—it’s an helpful money software. You can make use of Dave’s ExtraCash function in order to borrow upwards in purchase to $500, centered upon how very much you’re in a position to end upwards being in a position to pay back again upon typically the next payday. Consumers are expected to become capable to pay back the interest-free advance just as their own following salary will be transferred. An Individual can likewise decide to be capable to have your own funds advance sent to end upwards being capable to your current current debit cards or financial institution accounts. This Particular will consider a little lengthier, but a person won’t require in buy to change your primary downpayment in order to be eligible for a money advance, as many other programs require.

Understanding Borrow Cash Applications

We All consider exactly how uncomplicated it is to be in a position to understand the program procedures plus just how swiftly a person can obtain money. Right After all, a fast borrow cash app ought to not only provide quickly accessibility in order to funds nevertheless furthermore simplify the borrowing procedure with out including in buy to your current stress. Furthermore, customer service high quality is usually scrutinized to ensure that will a person could receive well-timed in inclusion to helpful assistance if concerns occur. The Particular best pay advance application Quotes Centrelink include MyPayNow, ZayZoon, Beforepay, WageTap, WagePay plus InstaPay amongst others.

With Vola Finance, a person could access upward to $300 with zero curiosity or invisible fees. Almost All that’s necessary will be a membership fee, which often typically runs through around $3 to $29 for each calendar month. This Particular charge is a little value for the particular peacefulness associated with brain that arrives with understanding you have a monetary safety web.

📌 First Circle Business Mortgage

Once you’re verified, a person may request up to $100 right away to include bills or urgent costs. The Earnin software sticks out with respect to their “access gained wages” approach in addition to is usually actually FREE (not “free” yet with a lot associated with invisible costs). Typically The lender claims the particular entire process—from asking for funds to obtaining them—takes concerning something like 20 minutes. Chime’s MyPay is usually best for existing Chime users that might like in buy to get their advance within just 24 hours with respect to no payment. Putting Your Signature On upwards for Current furthermore offers an individual a Current debit card, which often an individual may employ at thousands regarding merchants or take away cash coming from practically forty,000 ATMs with zero payment. LendingClub’s origination fees could become as higher as 3% to end up being able to 8%, which often could reduce the particular total lent amount.

Greatest Total Quickly Individual Loan

The Particular high interest rates could take a cost upon your current funds when an individual fail to be in a position to pay upon moment. Traditional financial institutions in addition to government loan providers perform credit bank checks to evaluate a borrower’s ability in order to pay. Upon the other palm, on-line lenders generally don’t plus simply demand a appropriate IDENTIFICATION or resistant regarding income. Within these monetarily trying times, the particular require to borrow cash will be understandable. Several Filipinos apply regarding conventional loans from banks and borrow money cash advance app government firms yet fall short to satisfy stringent financial loan needs. Because regarding this particular, they check out informal funding alternatives just like on the internet loans to be able to finance their particular immediate money requires.

Greatest Cash Advance Programs Regarding 2024: Fast And Easy Techniques In Purchase To Leading Up Your Own Bank Accounts

Typically The software tends to make money by indicates of marketing, allowing users in purchase to borrow without having any charges or attention. Klover likewise consists of spending budget equipment in addition to investing monitoring, generating it simpler to end up being able to control your current funds. The Particular Albert app is usually free in buy to get plus gives a collection associated with cash supervision resources, spending insights, and cost savings ideas. Received a question about getting out a car loan, the greatest way in buy to pay down your credit rating cards balances or exactly how to build upwards a good emergency fund? You’ll obtain a 1 month totally free test of Albert Geniuses any time a person sign upwards along with Albert.

In addition, a person may acquire your own funds immediately with consider to free together with an Enable charge cards. Such As several apps on this specific checklist, Current doesn’t cost interest or need a credit rating check. Nevertheless in contrast to the majority of some other applications, presently there is zero membership fee and in case you’re already making use of Current, a person could have got typically the cash sent to your Current accounts within moments to make use of however an individual such as.